Pet supplies saw immense growth in 2023, with GMV among top retailers up 16% vs 2022.

Generalists Amazon and Walmart contributed largely to the category’s growth, growing their market share at the expense of pet supply pure players, Petco and Chewy. Amazon saw the largest market share gains in the category, up +2.2 pp, while Petco was the largest share loser, down -1.4 pp.

What’s driving Amazon and Walmart’s accelerated gains?

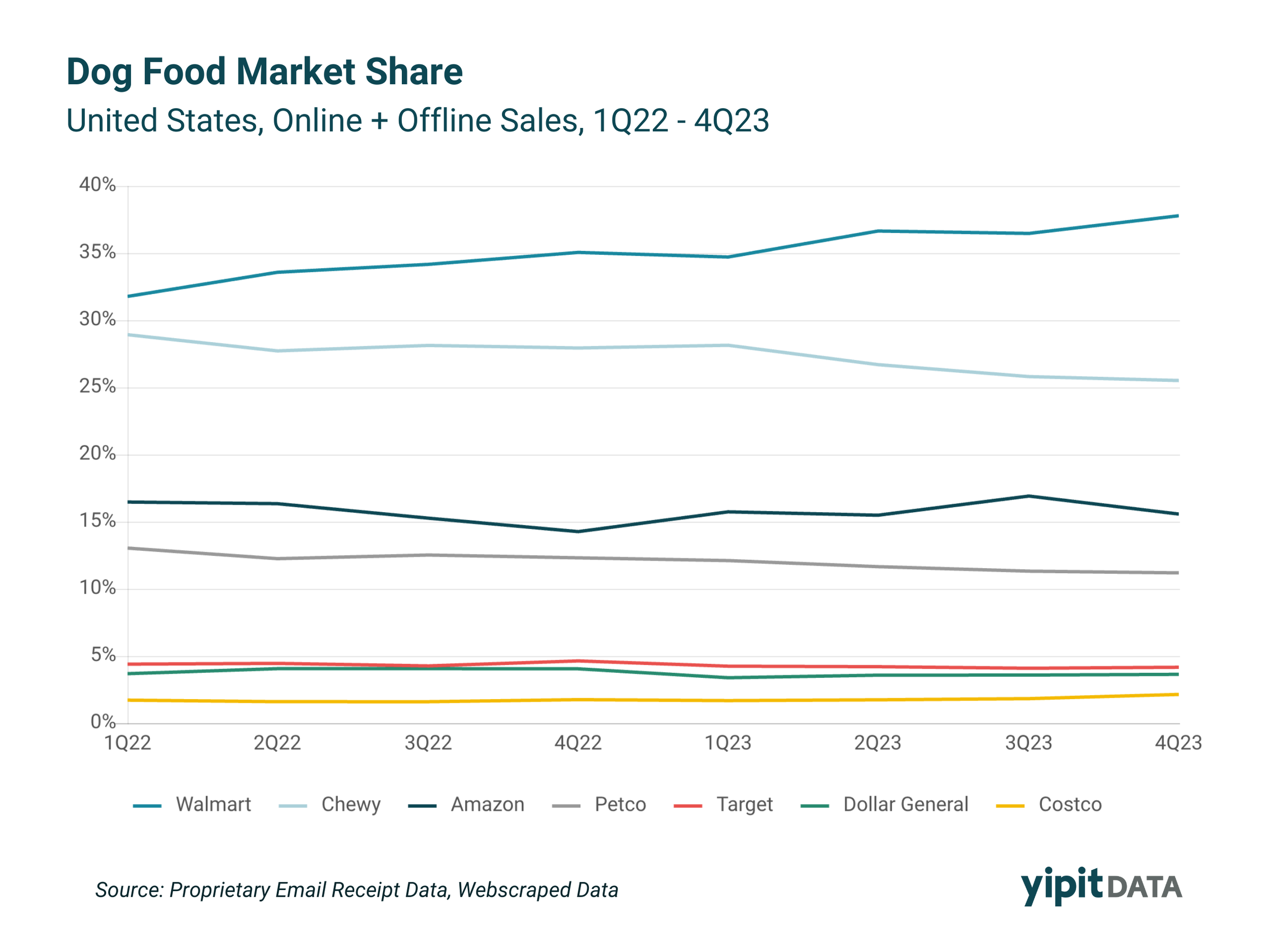

Walmart has seen outsized share gains specifically in Dog Food. The retailer grew its share of the subcategory by nearly 6 pp from 1Q22 to 4Q23. During the same period, Chewy experienced large share losses, declining by -3.4 pp.

Which dog food brand is driving Walmart’s growth?

A few brands have significantly growth their share of Dog Food sales at Walmart. In 4Q23, Pure Balance grew its share of sales 1.45 pp vs 4Q22. Purina also experienced some share of sales growth, up 0.84 pp vs 4Q22. However, a newcomer to the Dog Food space is largely contributing to Walmart’s success – Freshpet.

Emerging Pet Food brand, Freshpet, is gaining momentum driven by growth at Walmart and Costco. In 4Q23, YoY GMV growth reached 104% at Costco and 60% at Walmart, far surpassing counterparts Target (14%) and Petco (-3%).

By the end of 2023, Freshpet food products comprised nearly 1.5% of the total Pet Supplies category at Walmart.

Interested in custom Pet Supplies insights for your business?

View Original Article