Volume 5 of WitsNotes brings you the second year of Merkle’s research on Retail Media.

- Title: The Evolution of Retail Media Networks

- Author: Merkle

- Topic(s): Retail Media

- Length: 55 pages

- RetailWit Summary: 5 pages

Summary

Last year, Merkle surveyed 100 retailers, brands, and consumer packaged goods (CPG) companies about their approach to retail media solutions, with the aim of understanding attitudes around retail media networks (RMNs). A year later, and nearly two years into the pandemic, Merkle has repeated its research to gauge adoption of RMNs, new players in the industry, and what compels retailers and CPGs to pursue new ecommerce solutions.

5 Key Themes:

- Increased Brand Investment

- Evolution of RMN Offerings

- More Partners and Greater Expertise

- Non-Endemic Opportunities

- Access to First-Party Data

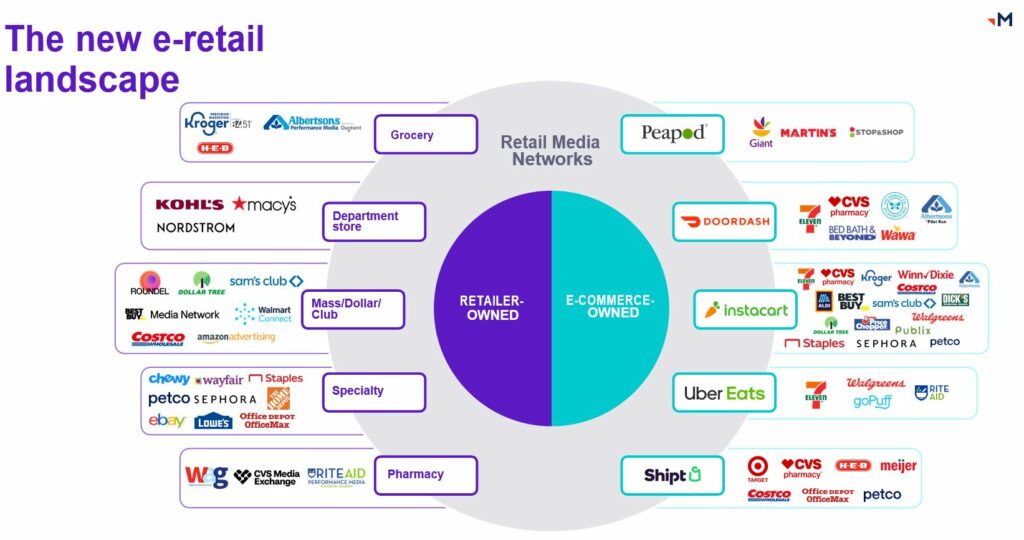

RMN Landscape

Retailers and CPGs have worked together for many years on traditional shopper programs, RMNs are an evolution and extension of those, not a replacement. In some areas, RMNs are used to amplify existing ‘tent pole’ events that brands are already buying into. In other cases, retail media is linked to shopper programs and negotiated as part of joint business planning (JBP) which includes the merchant and RMN organization.

The landscape is becoming much more competitive as retailers realize and pursue this opportunity. Most CPGs, rather than seeing this as a challenge, see it as a positive as they now have more options in finding the right retail partners coupled with increased bargaining power.

- 81% of CPGs intent to grow their investment in RMNs

- 93% of CPGs see the current e-retail media landscape as a benefit

Retail Media Continuum

Not all retail media offerings are created equal. Some are extensions of shopper marketing, some are merchant-led, some position themselves as a retailer vs a publisher. There are some that focus more on product vs audience in their go to market strategies. While there is no right or wrong positioning, Retailers need to be clear how they position their offerings in the market and be transparent to their vendors.

For Retailers

The goal is to take all of the aspects that make your business uniquely yours, and turn them into a unique selling proposition for your RMN.

- Be clear about what you want to achieve both financially and from an ad solution or offering perspective

- Create a roadmap that adds additional differentiation

- Be connected to what your vendors & non-endemic buyers are looking for

- Evolve your business instead of reacting to changes in the landscape

RMN are getting more sophisticated – As RMNs move out of the nascent stage they are beginning to focus on innovation and offer new solutions. Last year the focus was on margin, while this year RMNs are working to stay ahead of competition.

CPGs are looking for innovative ad solutions w/ real time dashboards and optimizations as well as easier relationships and managed service offerings

Creative can be an RMN differentiator – When asked of key features they were looking for; 40% of CPGs view “personalization opportunities through creative” as one of the biggest benefits of retail media networks they are looking for, and 43% call out “creative services.” However, only 10% of retailer respondents offer dynamic creative optimization (DCO) as part of their solution.

Retailer considerations in adding creative to their RMN offerings:

- Leverage creative expertise – RMNs need to ensure a creative expert has a seat at the leadership table.

- B2B is just as important at B2C – Leverage the creative team or RMN-experienced agency to help develop compelling B2B marketing content supported by a strategic omnichannel communications strategy.

- Creative as a direct source of revenue – Lastly, as creative is playing a larger role in supporting RMNs and the business is scaling remember the staffing requirements and related costs grow with it.

Relationship building has become a priority – your vendors become your clients in an RMN. Shifting these relationships to be more service-oriented and partnership focused will be key in securing incremental investments and keeping your advertisers happy. This will require senior level buy in that champions new ways of working and thinking about engaging with brands and agencies.

- 60% of retailers see their largest opportunity as solidifying partnerships with vendors.

- 90% of retailers with monetization programs work with their vendors’ agencies “always” or “most of the time” when reviewing media plans, negotiating rates, or reviewing campaign wrap-up reports.

Technology partnerships and plans (buy/build/partner) are essential for scaling RMN platforms.

- 90% of retailers see finding the right partner as their biggest challenge for scaling their RMN.

Self Service is the future.

- 70% of retailers with monetization programs allow vendors to access all media inventory through self-service tools.

- 80% of CPG brands engage with RMNs exclusively through self-service tools; 11% do so through their agency partner.

Expanding opportunity for non-endemic brands

Thirty percent of surveyed retailers cite “providing a way to partner with non-endemic vendors” as their largest opportunity in 2021. That’s for good reason – non-endemic partnerships open up new, significant revenue streams for retailers and create better customer experiences for shoppers by filling gaps in product offerings

- 80% of retailers sell to non-endemic brands and another 10% are thinking about it.

For CPGs

Eighty-one percent of CPGs plan to spend more media dollars with RMNs in the next year. When asked the same question in 2020, only 52% of CPGs intended to spend more with RMNs.

Retail media is rapidly growing and evolving, it is becoming more competitive and complex. A key takeaway for brands is to ensure that the RMN request for incremental media dollars aligns to your goals across shopper, ecommerce, and brand media.

Be clear about your broader goals outside of trade or merchant agreements, and push for the innovation that will help you achieve them. But be aware that in most cases, greater spend unlocks greater customization and access to information.

Realize the value of your growing first-party data accumulated over the past 18 months of increased ecommerce engagement and look for retailers open to you bringing your own data to the relationship to develop unique segments and reward your shoppers with a more personalized experience.

Benefits of working with an RMN:

- Deliver on brand metrics and drive consumers along the path to purchase.

- Align with changing consumer behavior, ensuring presence across the consumer journey and digital shelf.

- Take control of your brand through a strategic approach to brand data.

Considerations when working with an RMN:

- Evaluate the digital media mix to understand how RMNs can fit into current objectives, or where incremental funding may be needed

- Consider how brand and shopper strategies and budget align with RMNs in the media mix and how RMNs can achieve marketing objectives. It is important to have an integrated and holistic approach to your brand across digital and in-store.

- RMNs offer the scale and highly valuable first-party data that allow them to be considered within brand, shopper, and commerce initiatives.

- Structure for success – 96% of CPGs have formed a center of excellence to support RMNs in 2021, an increase of 10 points over 2020.

Funding RMNs

CPGs are funding RMN from 3 main buckets: 1. Shopper/Trade dollars, 2. Brand Media, 3. Ecommerce media.

- Shopper/Trade, 37% (up 12 points YoY)

- Brand Media, 41% (up 2 points YoY)

- Ecommerce media, 41% (up 2 points YoY)

First party data:

There is now a greater focus on first-party data and the immense value it can add for CPGs, especially with increased privacy restrictions and the impending deprecation of the third-party cookie. 62% of CPGs naming first-party data as one of the biggest benefits of working with an RMN, up from 33% just a year ago.

It isn’t just a one-way-street thought; CPGs have their own first party data and must consider their approach on how to use it within RMNs.

They must know:

- Who the customer is

- Where the customer is shopping

- How to enable the power of first-party data for personalization in a walled garden

Glossary:

RMN (Retail Media Networks) – Advertising platforms that monetize first-party data, insights, and advertise on both retailers’ websites and digital properties as well as out-of-home or in-store tactics, which were previously held by retailers’ merchant organizations

Endemic and non-endemic brands – An endemic brand creates products and/or services directly for the industry in which they are advertising. Non-endemic brands are businesses whose products and/or services are not directly linked to the market, but still benefit from the marketing strategy.

JBP (Joint Business Planning) – Joint business planning is any form of collaboration where retailers and CPGs make informed decisions to establish and reach the same goals. Typically, this collaboration involves conversations between senior management to find common ground and shared pain points.

DTC (Direct to Consumer) – Direct-to-consumer or business-to-consumer refers to selling products directly to customers, bypassing any third-party retailers, wholesalers, or any other middlemen.

CTV (Connected TV) – also referred to as over-the-top (OTT), are ads that can be placed on any TV or device that can be connected to the internet and access video streaming content beyond what is available via the normal offering from a cable provider

DCO (dynamic creative optimization) – a form of programmatic advertising that allows advertisers to optimize the performance of their creative using real-time technology. In DCO, a variety of ad components are dynamically assembled on the flight, when the ad is served, according to the particular needs of the impression.

The full whitepaper is available at www.merkleinc.com.

*All views presented in this article are those of Merkle and the original authors, not necessarily the views of RetailWit.

Final Words – The RetailWit Take:

A very thorough and well written article from Merkle with some real gems to learn from, it is well worth the read. However, the fact that KPM (Kroger Precision Marketing) is not referenced does make us question the validity of the research and/or the sample chosen. If this survey was CPG based, somehow missing the largest grocer in the United States is a major red flag. (*see below)

And now onto the Top Retail News from last week, there were some BIG stories so read on!

Walmart announces a new product offering complementing the retailer’s forthcoming DSP.

Really big news coming out of Walmart as they will begin commercializing their data with the help of dunnhumby, the OG in data commercialization.

“They are both examples of how part of Walmart’s strategy of continuing to build alternative revenue streams and profit pools is coming to life. Walmart Luminate is very much focused on providing data and insights that inform business decisions and the DSP is building and executing compelling campaigns that reach customers.”Walmart and Netflix Team Up.

In June of this year Netflix moved into commerce with a launch of their own online store. Then in July announced they are moving into physical retail. Last week, they announced that they are moving deeper into commerce by teaming up with Walmart Inc. to create a digital storefront on the retailer’s website that will sell merchandise. Netflix clearly sees diversifying out of pure play streaming as important as the “stream wars” continues to grow more intense.

Kroger expands Delivery to new markets.

The Northeast, Florida, and California will have first-time or expanded Kroger Delivery options. No timing has been announced yet, but Ocado CFCs and new, smaller MFCs (dubbed ‘Zoom’) will be built. Kroger Delivery will “serve customers as fast as 30 minutes…. [and] deliver same-day and next-day orders.

Best Buy acquiring Current Health for home health care.

The owner of the geek squad continues to target the older generation. Best Buy has been strategically focused on getting into healthcare, and acquiring Current Health is their latest move. Essentially, the firm offers digital health technology and capabilities. Healthcare is a battleground for Retail, and this is the first Retailer move we’ve seen towards home health.

RetailDive shares some of the most notable experiential concept launches this year.

It may be a sign that things are returning to normal as Retailers are resuming testing new store concepts leaning heavily into experiential retail, which, in our opinion, will be the differentiator of successful retailers in the future.

- Dick’s House of Sport and Public Lands

- Target’s Ulta shop-in-shops

- Bloomingdale’s small-format Bloomie’s concept

- Casper’s shop-in-shop at Bed Bath & Beyond

- Wilson’s first-ever brick-and-mortar stores

- Nordstrom’s Indochino shop-in-shops

Walgreens Q4 tops estimates and launches new business segment.

Net income increased to $627MM (vs $372MM YA) and adjusted earnings per share were $1.17 (vs analyst estimate of $1.02). Comparable pharmacy sales +8.1%, comparable retail sales +8.9%. It reached annual cost savings ahead of schedule ($2B). A very, very solid performance. They also announced launching a Healthcare-based business segment, having made significant investments in VillageMD and CareCentrix, which they view as their growth engine.

Congress Makes Moves To Rein In Online Retailers, Platforms.

Targeting Big Tech, the pen is starting to meet paper on regulations against Facebook, Apple, Amazon, and Google. The goal is to essentially eliminate the advantages their owned platforms give them over competitors and the protections they have from section 230. Regardless, the target on Big Tech is clear—how much regulation actually gets passed remains to be seen.

Walmart beta tests text-to-shop feature. Another innovation stretch, Walmart looks to make it even easier to text for customers. It’s another “step forward its voice-activated shopping offering.” This will bring a whole new meaning to drunk texting.

A REUTERS SPECIAL REPORT shows that Amazon copied products and rigged search results to promote its own brands.

Straight from the “no SH*T!” news desk and surprising nobody at all, a new report shows that Amazon is leveraging its data to develop and market its owned brands.

A trove of internal Amazon documents reveals how the e-commerce giant ran a systematic campaign of creating knockoff goods and manipulating search results to boost its own product lines in India – practices it has denied engaging in. And at least two top Amazon executives reviewed the strategy.

Target announced a limited-edition collection with the LEGO Group.

The collection features a lifestyle assortment that goes well beyond the company’s iconic brick, with joyful, colorful items across home goods, pets, toys and gifts, as well as apparel and accessories for the entire family.

We, obviously, have an affinity for Legos as well!

Gap Inc. Acquires AI Startup CB4

Gap Inc. announced that it’s acquiring the New York- and Tel Aviv-based startup Context-Based 4 Casting (CB4), which uses artificial intelligence (AI) and machine learning to identify patterns in retail data and identify ways to improve in-store sales.

It is totally missed opportunity if Gap doesn’t use Chris Rock in their next commercial. If you are wondering. CB4 is a classic Chris Rock movie.

RetailDive shares some of the most notable experiential concept launches this year.

It may be a sign that things are returning to normal as Retailers are resuming testing new store concepts leaning heavily into experiential retail, which, in our opinion, will be the differentiator of successful retailers in the future.

- Dick’s House of Sport and Public Lands

- Target’s Ulta shop-in-shops

- Bloomingdale’s small-format Bloomie’s concept

- Casper’s shop-in-shop at Bed Bath & Beyond

- Wilson’s first-ever brick-and-mortar stores

- Nordstrom’s Indochino shop-in-shops

Dunkin’s New Halloween Costumes are a Hit!

Once again, Dunkin’ has partnered with Spirit Halloween this month with a sweet lineup of Dunkin’-inspired Halloween costumes guaranteed to brew up attention this season that are sure to drive incremental value and new electricity into the brand.

Doordash launches ad business.

It’s here. Mostly an unprofitable business model, Doordash hopes to gain an alternative revenue stream through ads. Featured Listings (for CPGs) and search result ads are new advertising solutions offered to marketers. Doordash is planning to limit the number of ads shown (up to two depending on the category for now). They say it’s so customers don’t get frustrated by the experience—and we wonder if it will artificially increase the ad purchase costs.

Walgreens adds two executives to C-suite.

Coming from CVS and Starbucks, Holly May will be the CHRO and Anita Allemand will lead a newly formed role of “Chief Transformation and integration Officer.” This role will be the strategic thought leader to Roz Brewer (CEO), and “lead the overall transformation agenda… as the company prioritizes its strategy and path forward in healthcare.”

No Comments

Leave a comment Cancel